| UNICORN MACRO FUND 1 | |||||||||||||

| Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | YTD | |

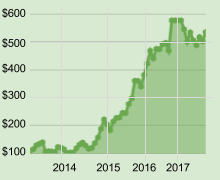

| 2018 | 0 | (1.53) | (0.01) | 2.99 | 2.28 | - | - | - | - | - | - | - | 3.73 |

| 2017 | 0 | 0 | (5.75) | (8.14) | 6.59 | (5.30) | (3.44) | 5.99 | (2.94) | 6.47 | 2.25 | (2.83) | (6.87) |

| 2016 | (5.57) | 12.25 | 10.68 | 10.87 | (5.84) | 7.77 | (0.27) | 3.74 | 1.00 | (5.57) | 23.08 | 0 | 52.12 |

| 2015 | 17.87 | (8.16) | (10.08) | 17.10 | 5.98 | 0.78 | 7.17 | (0.32) | 13.27 | 7.52 | 21.05 | (0.16) | 72.02 |

| 2014 | (11.66) | 1.84 | (0.25) | 15.12 | 11.01 | 5.69 | (7.69) | (9.24) | 3.09 | 14.08 | 14.78 | 19.70 | 56.42 |

| 2013 | 9.77 | 4.94 | 12.15 | 4.30 | 3.77 | (23.35) | 0.37 | (0.85) | (1.58) | 16.99 | (1.92) | (4.86) | 19.73 |

|

Unicorn Macro Fund's modeled performance is based on real-time paper-trading.

The results are calculated based on monthly performance since January 2013.

The performance of Unicorn Macro Fund is measured by Net Asset Value (NAV), which is net of all fees, unaudited, and may include the use of estimates.

Individual results will vary based on the timing of an investment and past performance is no guarantee of future results and there is a possibility of loss.

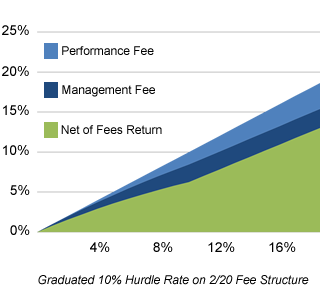

There are no expenses and all fees are annualized using a High Water Mark and a Graduated 10% Hurdle Rate.

The Graduated 10% Hurdle Rate is derived from a limited function that scales from 0% to 100% when annualized Performance is between 0% - 10%.

For example, for annualized performance greater than 10%, the full 2% management fee and 20% performance fees fees are charged,

for an annualized performance between 0% and 10%, only a portion of management and performance fees are charged and for annualized performance below 0%, no fees are charged.

|

|||||||||||||

|

LEGAL DOCUMENTS | |

|

OFFERING DOCUMENTS |

TEARSHEETS |

|

|

REGULATORY FILINGS |

|

|

|

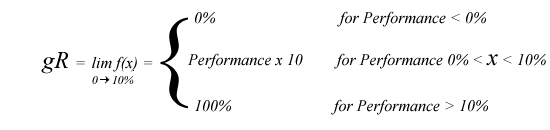

FEE CALCULATION: Graduated 10% Hurdle Rate ("gR") |

|

|

|

Monthly Management Fee = (0.5% / 12) x Monthly Ending Balance During the year, on the last day of the month, Unicorn Capital Partners charges 0.042% management fee on the ending balance of each partner's capital account(s). |

|

|

Management Fee = 2% x gR x Ending Balance - Monthly Management Fee On the last day of the fiscal year, or on a withdrawal or redemption, Unicorn Capital Partners charges a management fee based on the Graduated 10% Hurdle Rate less the monthly management fees already charged. If the management fee is less than the monthly management Fees already charged, we will return the difference. |

|

|

Performance Fee = 20% x gR x (Performance - Highwatermark - Management Fee) On the last day of the fiscal year, or on a withdrawal or redemption, Unicorn Capital Partners charges a performance fee based on the Graduated 10% Hurdle Rate attributed to each partner's performance minus high water mark and management fee. |

|

|

Fee Strcture - the Graduated 10% Hurdle Rate ensures that our interests are aligned with our partners by charging fees based only on performance. The Graduated 10% Hurdle Rate ("gR") is derived from a limited function that scales from 0% to 100% when annualized Performance is between 0% - 10%. To calculate fees, this "gR" is applied to the 2% management fee and 20% performance fee. For example, for annualized performance greater than 10%, the full 2% management fee and 20% performance fees fees are charged, for an annualized performance between 0% and 10%, only a portion of management and performance fees are charged and for annualized performance below 0%, no fees are charged. |

|

|

WORKING PAPERS |

|

The central banks are the largest traders in the market, so these working papers

are meant to help us understand what the central banks are doing.

|

|

PORTFOLIO MANAGER | ||

|

Peter del Rio

Unicorn Capital Partners, LLC

Managing Member Unicorn Macro Fund, LP

|

Peter has over 36 years experience in Applied Mathematics, Finance and Technology. He began his career at Merrill Lynch Capital Markets in 1982, where he traded the first

Collateralized Mortgage Obligation (CMO). He went on to trade Government National Mortgage Association bonds, GNMAs for Merrill Lynch, Dean Witter and Donaldson

Lufkin & Jenrette and traded FNMAs and FHLMCs for Greenwich Capital.

After an illustrious career on Wall Street, he founded IC3D |

||

|

|||